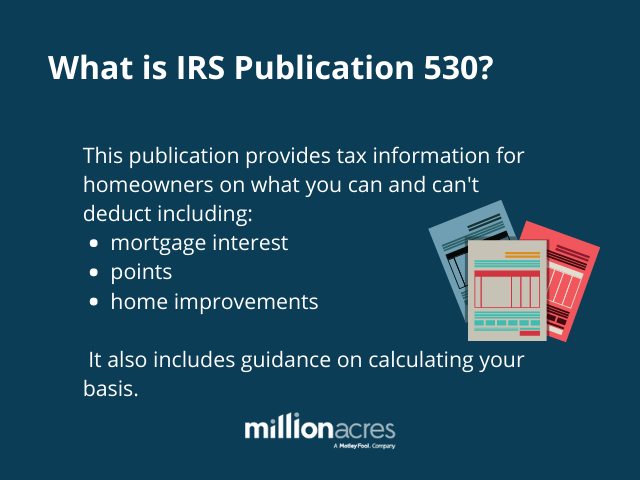

Home Improvement Tax Credit. In other words, a tax credit that exists today for, say, replacing your attic insulation, might not exist next year or, if it does exist Here's how to add your roof tax deduction to your tax return and the requirements to receive a roof tax credit. Can you get deductions for your child's college expenses?

Can you get deductions for your child's college expenses?

Tax credit for home improvement loans.

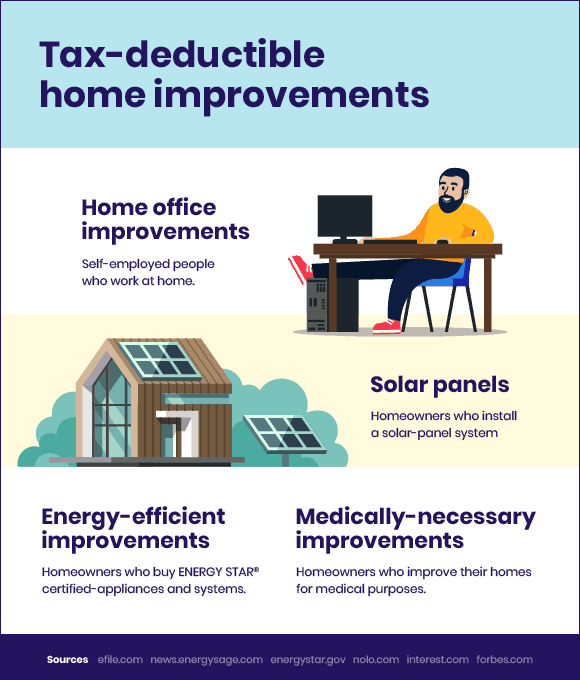

Home Improvement Tax Credit can help you save money while improving the energy efficiency of your home. Get cash for home repairs, remodeling projects and more without using equity in your home. * Advertiser Disclosure†. Home improvements are more affordable and beneficial for you if you go with ones that fall under the Non-business energy property credit and the residential energy efficient property credit.

0 Comments